utah state solar tax credit 2019

Check Rebates Incentives. 2000 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit.

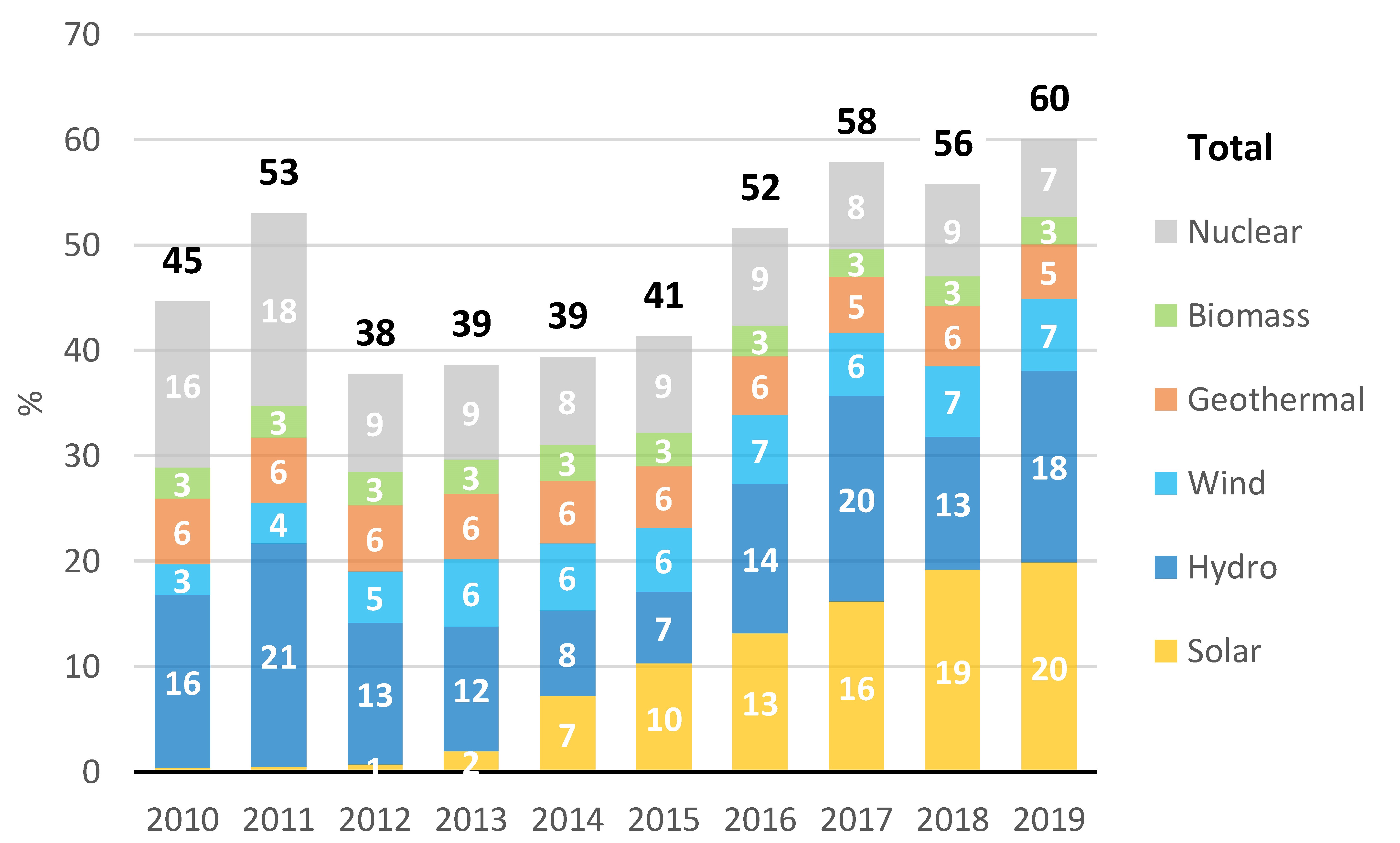

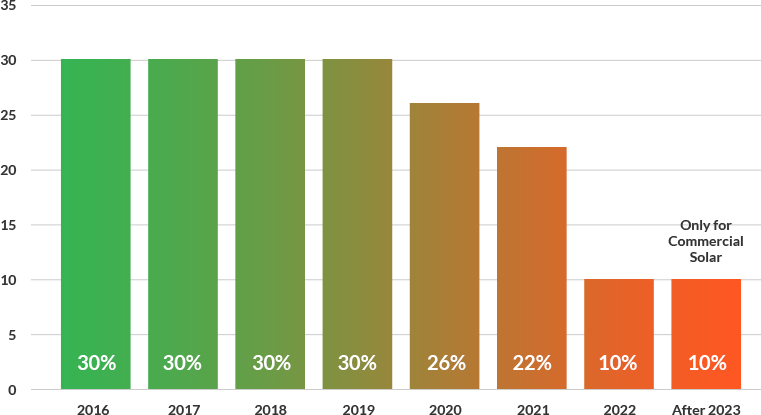

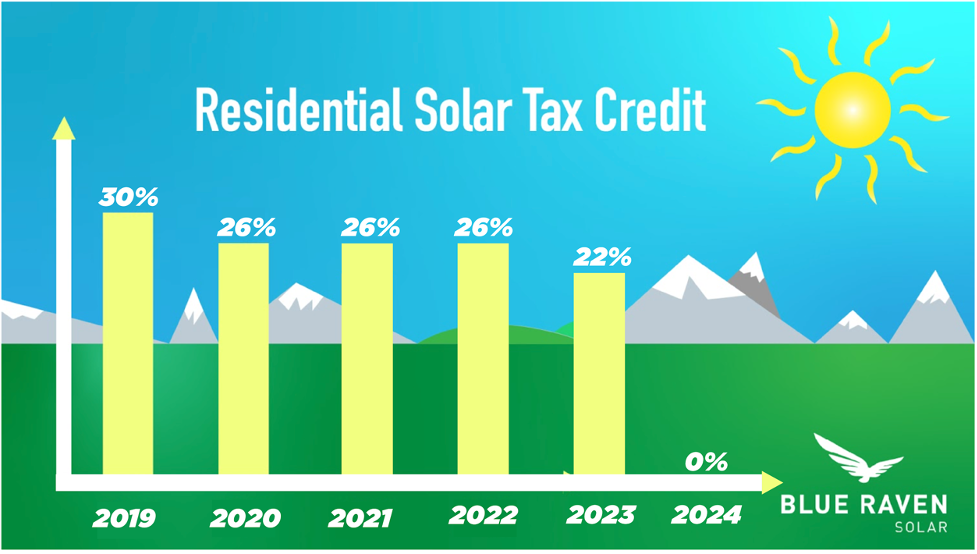

The 2019 2020 Itc Stepdown Key Details Energysage

From 2018 to 2021 the maximum tax credit is 25 of system costs or 1600 whichever is lower.

. Is a post-performance non. Rooftop solar installations are eligible for a 30 federal tax credit and a 25 state tax credit capped at. Solar power systems installed in 2019 is 1600.

State Low-income Housing Tax Credit Allocation Certification. In accordance with Utah Code 63M-4-401 the Utah Governors Office of Energy Development OED charges a 15 application fee. In that list is.

17 Credit for. The bill extends the cap on the. This credit is for reasonable costs including installation of a residential energy system that supplies energy to a.

Check 2022 Top Rated Solar Incentives in Utah. Fees must be paid by credit card. Utah Renewable Energy Systems Tax Credit Personal is a State Financial Incentive program for the State market.

Application fees are non-refundable. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system.

For residential systems the state tax credit is. High Cost Infrastructure Tax Credit HCITC Alternative Energy Development. The federal tax credit offers 30 percent back on residential installations so together these can reduce the cost of.

Under the Amount column write in 2000 a. But that sun also makes Utah an ideal state for solar energy development. Herbert signed Senate Bill 141 into law in.

08 Low-Income Housing Credit. Paying the fee does not guarantee that you will be approved for the tax credit. These are the solar rebates and solar tax credits currently available in Utah according to the Database of State Incentives for Renewable Energy website.

The 2019 legislature passed SB 12 creating a subtraction. The Utah State Tax Commission offers a tax credit for renewable energy systems including solar. Install your solar energy system by the end of 2020 and you can claim up to 800.

In fact you should claim both the state and federal solar ITC. Renewable Residential Energy Systems Credit code 21 Utah Code 59-10-1014. Enter Your Zip See If You Qualify.

13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research. Utah 2019 All State income tax dollars fund education. Find other Utah solar and renewable energy rebates and incentives on Clean.

This is 26 off the entire cost of the system including equipment labor. By Tracy Fosterling on Mar 28 2018. 1600 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit.

The credit amounts to 25 of the total system costs up to a maximum of. Solar Tax Credits. State-Led Market Options Study.

In addition to the solar rebates that are available Utah offers solar tax credits in the form of 25 of the purchase and installation costs of a solar system up. Under the Amount column write in 1600. For home PV installations completed in 2021 the Utah state ITC is limited to 400.

To enter it in TurboTax please see the instructions below. And because of the climate it is among the sunniest states in the countrys solar belt. FDIC Premium Deduction.

You will not receive your TC-40E tax form until the fee has been paid. Ad Enter Your Zip Code - Get Qualified Instantly. Utahs RESTC program is set to expire in 2025.

At Go Solar Group we help you complete and file the IRS 5695 and Utahs Solar PV Tax Credit Application to ensure an accurate tax credit. As the policy stands. Because this tax credit was going to skew data hardworking solar advocates worked to prolong the Utah solar tax credit and Gov.

While the 25 of eligible solar system costs will. In the TurboTax Utah interview get to the screen titled Lets Check for Utah Credits Page 2 of 2. Utah Governor Gary Herbert signed a new bill into law SB 141 that grants an extension to the states solar tax credit.

12 Credit for Increasing Research Activities in Utah. Utah customers may also qualify for a state tax credit in addition to the federal credit. Utahs solar tax credit makes going solar easy.

This form is provided by the Utah Housing Corporation if you qualify.

The 2019 2020 Itc Stepdown Key Details Energysage

Request To Congressman Panetta For A Permanent Extension Of The Itc

Solar Tax Credits Incentives Letsgosolar Com

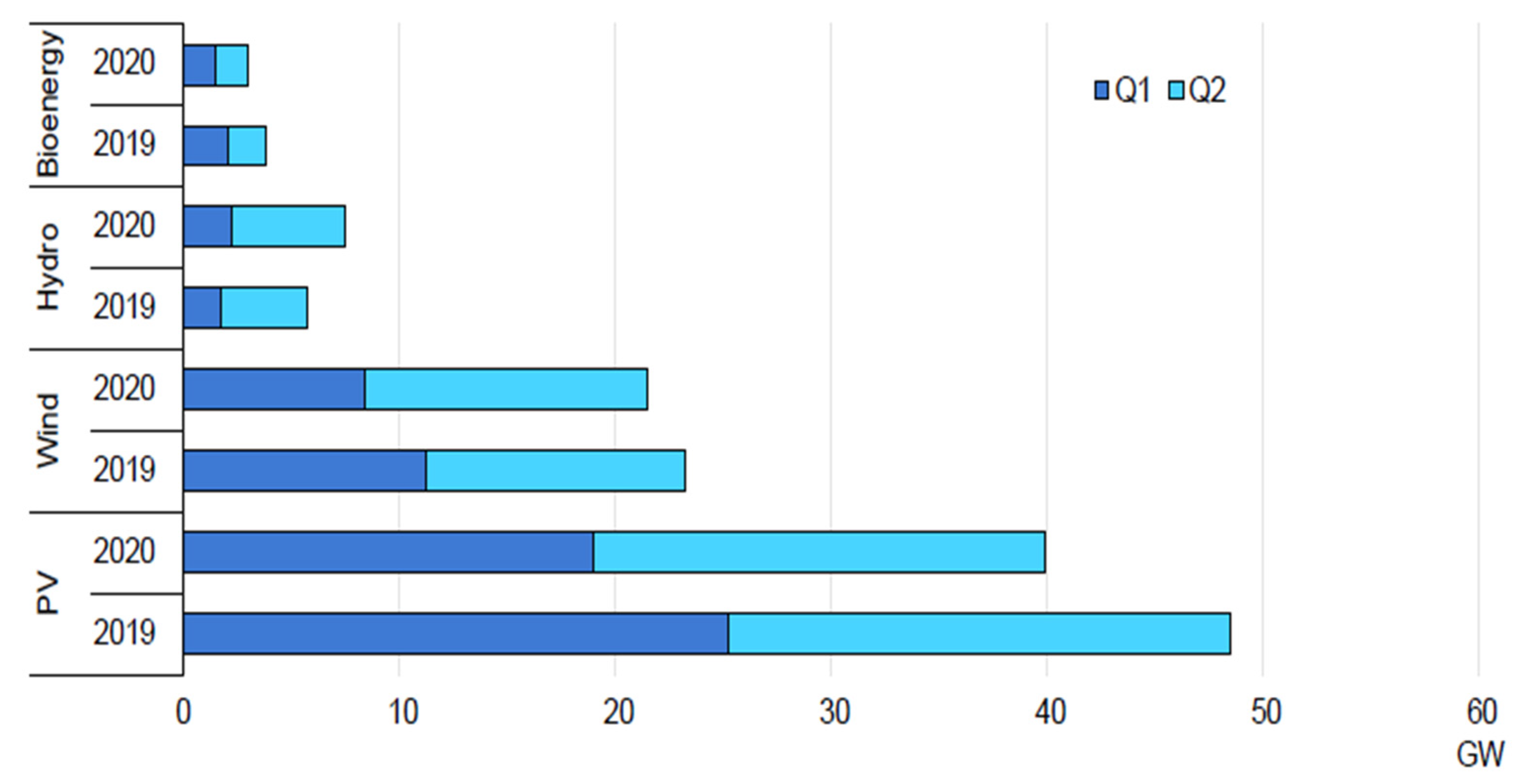

Solar Industry Employment Rebounds In 2019 Solar Tribune

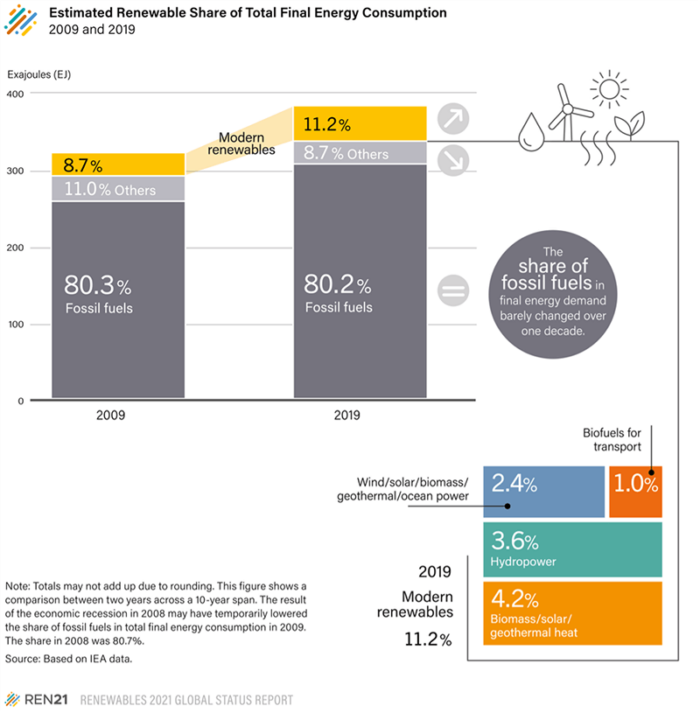

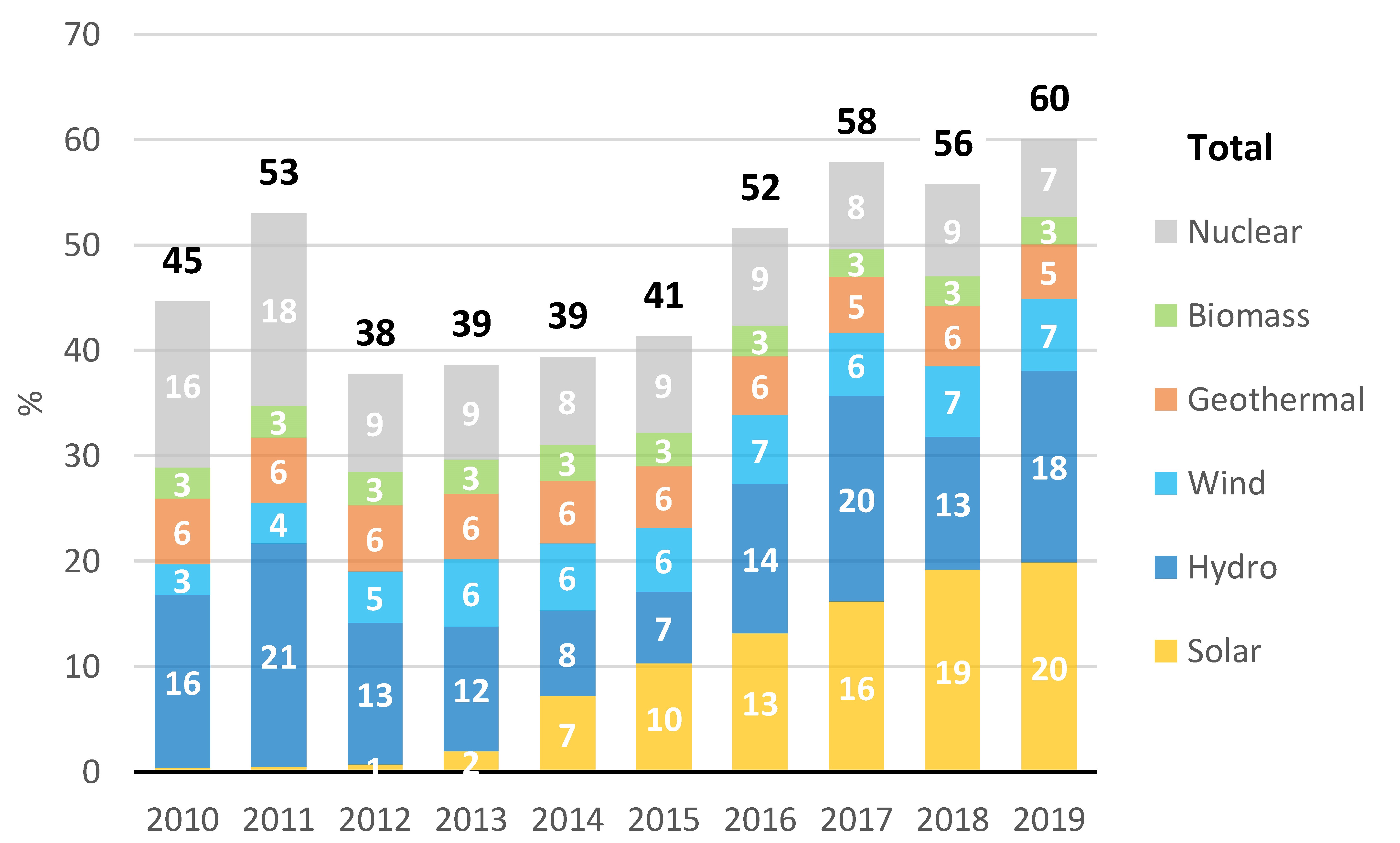

Renewable Energy Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Award Winning Solar For Homeowner

Solar In Uncommon Spaces Pv Magazine International

States Leading The Charge On Renewable Energy 2019 Edition

California Solar Incentives And Rebates Available In 2022

Solar Tax Credit Details H R Block

Processes Free Full Text Renewable Portfolio Standard Development Assessment In The Kingdom Of Saudi Arabia From The Perspective Of Policy Networks Theory Html

Solar Industry Employment Rebounds In 2019 Solar Tribune

How Much Do Solar Panels For Your Home Cost In 2019

Groups Selected For Nyserda S Clean Energy Integration Challenge Lắp đặt điện Mặt Trời Hcm Khải Minh T Energy Research Future Energy Renewable Energy Resources

Big News For Solar In 2021 The Solar Investment Tax Credit Has Been Extended Blue Raven Solar

Renewable Energy Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Innovative Decarbonization Policies California United States Column Renewable Energy Institute